Pradhan Mantri Awas Yojana Loan Scheme 2022

Pradhan Mantri Awas Yojana Loan Scheme 2022 – Tenure Increased to 20 Years under CLSS for EWS, LIG & MIG

Table of Contents

Pradhan Mantri Awas Yojana Loan Scheme 2022 Tenure: Central government cabinet has approved the extension of the loan tenure under the Credit Linked Subsidy Scheme component of Pradhan Mantri Awas Yojana – Urban. The loan tenure which was an earlier maximum of 15 years has been extended to 20 years, which means lower EMI’s for the home loan borrowers. In addition to CLSS for EWS, and LIG Category, the government has also introduced a new CLSS loan scheme for the middle-income group of the society.

Income Eligibility for PMAY Home Loan

Income eligibility criteria for Pradhan Mantri Awas Yojana have been revised by introducing a new income level category. As per the new income eligibility criteria, people with higher income can also avail subsidy on housing loans. Prime Minister Narendra Modi also announced the increase in the home loan amount on 31st December.

The government has now also increased the PMAY home loan tenure from 15 to 20 years. As per the earlier scheme, people with an annual income below Rs. 6 lakh can avail of housing loans under the Pradhan Mantri Awas Yojana with an interest subsidy of 6.5% for a maximum of 20 years. The earlier scheme is however kept unchanged and new PMAY home loan schemes have been introduced. Below are the details of new income eligibility criteria for availing of home loans under Pradhan Mantri Awas Yojana – Urban.

| Maximum Annual Income | Loan Amount | Interest Subsidy | Maximum Tenure |

|---|---|---|---|

| 6 Lakh (Old) | 6 Lakh | 6.5% | 20 Years |

| 12 Lakh | 9 Lakh | 4% | 20 Years |

| 18 Lakh | 12 Lakh | 3% | 20 Years |

The maximum loan tenure for the earlier scheme was 15 years but now PMAY beneficiaries can avail housing loan for up to a maximum of 20 years from any of the PLI’s, Banks & HFC’s for Home Loan under PMAY.

As per the new home loan scheme, people having annual income of up to Rs. 18 Lakh can avail housing loan benefits under PM Awas Yojana for urban. The government is already disbursing loans under the earlier scheme for which the maximum annual income is 6 Lakh. The loans under the PMAY home loan schemes can be availed for new construction, purchase of a house or for refurbishing a houses which not suitable for habitation. The benefits of the scheme can also be availed by the government employees provided they pay the income tax.

PMAY CLSS Income Eligibility for EWS / LIG / MIG

- EWS households with an annual income up to Rs. 3.00 lacs are eligible for PMAY CLSS. Such EWS families can take loans up to Rs. 6 lakh with 6.5% subsidy. Loan amount above Rs. 6 lakh would not be eligible for interest subsidy. Maximum subsidy-eligible under CLSS-EWS – Rs. 2.67 lakhs (approx.)

- LIG households with an annual income between Rs. 3.00 lacs to Rs. 6.00 lacs are eligible for PMAY CLSS. Such LIG families can take loans up to Rs. 6 lakh with 6.5% subsidy. Loan amount above Rs. 6 lakh would not be eligible for interest subsidy. Maximum subsidy eligible under CLSS-EWS – Rs. 2.67 lakhs (approx.)

- MIG 1 category includes households with annual family income b/w Rs. 6 lakh to 12 lakh. The credit linked subsidy at 4% will be available for loan amount up to Rs. 9 lacs in case of MIG-I. Banks can sanction Home Loans more than Rs. 9 lakhs but the subsidy will be restricted to Rs. 9 lakhs. Maximum subsidy-eligible under CLSS-MIG(I) – Rs. 2.35 lakhs (approx.)

- MIG 2 category includes households with annual family income b/w Rs. 12 lakh to 18 lakh. The credit linked subsidy at 3% will be available for loan amount up to Rs. 12 lakhs in case of MIG-II. Banks can sanction Home Loans more than Rs. 12 lakhs but the subsidy will be restricted to Rs. 12 lakhs. Maximum subsidy-eligible under CLSS-MIG(II) – Rs. 2.30 lakhs (approx.)

The government is inviting online applications for PMAY for assessments of candidates through its official website pmaymis.gov.in

Houses under Pradhan Mantri Awas Yojana to have Lock-in Period of 5 Years

Central govt. has imposed a new condition on availing Home Loan Subsidy for Houses under Pradhan Mantri Awas Yojana (PMAY). Now all the people who have purchased new houses under PMAY Housing Scheme will not be able to sell their homes (property) before 5 years. Govt. has introduce a provision of “Lock-in Period” of 5 years for houses under Pradhan Mantri Awas Yojana (Gramin & Urban both).

Ministry of Housing affairs, Central govt. had earlier given its in-principle approval for the provision of Lock-in period. Official announcement for the same was made by the Union Cabinet. This notification will ensure that PMAY Scheme will benefit only those people who wants to purchase house for their own use.

This provision will avoid any misuse of this govt. “Housing For All” scheme. The main purpose of PMAY Scheme is to provide homes to needy & poor people.

PMAY Homes to Have Lock-in Period of 5 Years

Some people buy these houses to get rebate in Income Tax or to make investment in properties. There are certain apprehensions that people buy properties under PMAY Housing Scheme and sell-off their properties at higher rates to earn profits. This is because people get subsidy in the form of loans at cheaper rates to buy properties under PM Awas Yojana.

All the people can avail benefits of PMAY Scheme including those who wants to sell properties at higher rates. If people buy homes at cheaper loan rates under PMAY and sell it to any property dealer at market price, then the purpose of scheme is not served. Lock-in period will avoid and help in tackling such situation. The primary objective is to provide own-roof to every homeless person. That is why, such a huge amount of subsidy is being given to the people for construction & renewal of houses. To avoid any misuse of Pradhan Mantri Awas Yojana, the provision of a lock-in period of 5 years is an important and essential step.

Govt. Initiatives to Enhance Coverage of PM Awas Yojana

Central govt. has taken various measures, change old rules and has implemented new rules in order to increase the scope and coverage of PMAY. If the annual income of any person is up to Rs. 18 lakh, then he/ she can avail subsidy on houses up to 2150 sq.ft under Pradhan Mantri Awas Yojana (PMAY). On the purchase of houses, any MIG category person will get Interest subsidy on home loans and can save up to Rs. 2.3 to 2.35 lakh.

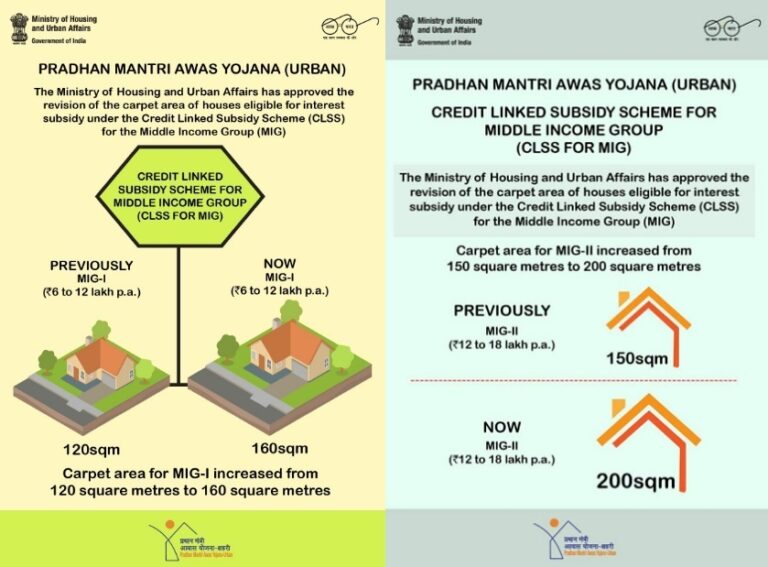

In urban areas, there are various provisions for affordable housing which includes Credit Linked Subsidy Scheme. Carpet Areas of Houses has been increased under CLSS component of PMAY U. CLSS is now expanded to include the Middle-Income Group (MIG) covering two income categories:-

| Category | Annual Income | Interest Subsidy | Carpet Area (w.e.f 1 Jan 2017) |

|---|---|---|---|

| MIG-I | Annual income between Rs. 6 lakh and Rs. 12 lakh | Interest Subsidy of 4% for loan amount up to Rs. 9 lakh | Carpet area for MIG-I is also increased from existing 120 sq.m to 160 sq.m. |

| MIG-II | Annual income between Rs. 12 lakh and Rs. 18 lakh | Interest Subsidy of 3% for loan amount up to Rs. 12 lakh. | Carpet area for MIG-II is also increased to 200 sq.m. |

Till 11 June 2021, the central govt. has given approval for the construction of around 112.52 lakh houses under PMAY. Construction is in various stages in more than 82.46 lakh houses and more than 48.31 lakh houses have been completed. Central assistance is Rs. 1.81 lakh crore out of which Rs. 96,067 crore has already been released. The total investment under PMAY Housing Scheme reaches to around Rs. 7.35 lakh crore.

Progress of Pradhan Mantri Awas Yojana (PMAY) Urban

Central govt. aims to construct 1 crore houses under PMAY Urban (PMAY-U) over a span of 7 years i.e from 2015 to 2022. The progress of Pradhan Mantri Awas Yojana (Urban) is shown below:-

This data is as of 11 June 2021. Now there is a Lock-in period of 5 years for PMAY Houses. This will avoid misuse of CLSS under the PMAY Housing Scheme. For more details PMAY Lock-in Period, click the link – https://pmaymis.gov.in/

Pradhan Mantri Awas Yojana Loan Scheme Tenure for MIG

| Criteria | CLSS (MIG-I) | CLSS (MIG-II) |

|---|---|---|

| Household/ Annual Income (Rs) | Rs. 6.01-12.00 lakhs | Rs. 12.01-18.00 lakhs |

| Property Area (Carpet Area ## ) | 160sqm | 200sqm |

| Location | Urban -2011* | Urban -2011* |

| Woman Ownership | NA | NA |

| Max Loan Amt for Subsidy | Up to 9 lakhs | Upto 12 lakhs |

| Subsidy % | 4% | 3% |

| Subsidy Amount | Rs. 2.35 lakhs | Rs. 2.30 lakhs |

| NPV | 9% | 9% |

| Max term of loan (on which subsidy will be calculated) | 20 yrs | 20 yrs |

| Property should be Family’s | 1st home** | 1st home** |

| Applicability | Loans approved on/after 01/01/2017 | Loans approved on/after 01/01/2017 |

PMAY Loan Scheme 2022 for MIG

The government has made a huge budgetary allocation for the proposed Credit Linked Subsidy Scheme for Economically Weaker Sections (EWS), Lower Income Group (LIG) and Middle Income Group (MIG).

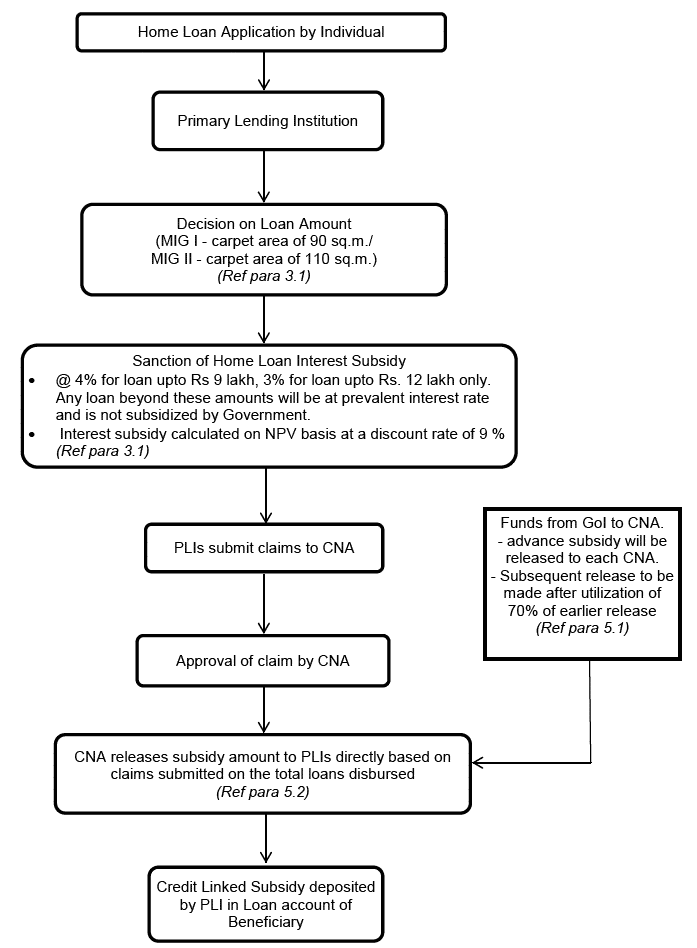

Now along with EWS / LIG category people, the middle income group of the society can also take home loans under the PMAY-U. If they are found eligible by the primary lending institutions, the interest subsidy will be credited to the home loan account of the beneficiaries.

The new Pradhan Mantri Awas Yojana loan scheme for Middle Income Group of the society will help reach the PMAY-U benefits to a larger group and help strengthen the mission of housing for all by 2022.

Recently Narendra Modi has also announced increase in the loan amount under PMAY from 6 lakh to 12 Lakh. Read the complete details about PMAY home loan subsidy / interest rates which were announced by Narendra Modi.

The government is inviting online applications for PMAY-U through two modes, first is assessment application through pmaymis.gov.in and second is through the common service centers across the country.

The complete details of the release about the amendment in CLSS for EWS/LIG and introduction of CLSS for MIG is available.

PMAY EWS / LIG Loan Scheme Tenure

The latest Pradhan Mantri Awas Yojana Loan Scheme Tenure for EWS / LIG Category people is as follows:-

| Criteria | Existing Instructions (CLSS – EWS +LIG) | Revised Instructions (CLSS – EWS +LIG) |

|---|---|---|

| Household/ Annual Income (Rs) | Up to Rs. 6 lakhs | Upto Rs. 6 lakhs |

| Property Area (Carpet Area ## ) | 30/60 sqm* | 30/60 sqm* |

| Location | 17778 towns | 17778 towns |

| Woman Ownership | Yes (except for construction) | Yes (except for construction) |

| Max Loan Amt for Subsidy | Up to 6 lakhs | Upto 6 lakhs |

| Subsidy % | 6.50% | 6.50% |

| Subsidy Amount | Rs. 2.20 lakhs | Rs. 2.67 lakhs |

| NPV | 9% | 9% |

| Max term of the loan (on which subsidy will be calculated) | 15 yrs | 20 yrs |

| Property should be Family’s | 1st home** | 1st home** |

| Validity | 2022 | 2022 |

| Applicability | Loans approved on/after 17/06/2015 | Loans approved on/after 01/01/2017 |

How to Apply for PMAY-U Loan Scheme

The eligible beneficiaries of PMAY can directly contact the banks and lending institutions to avail the housing loan under the scheme. The loan facility under Pradhan Mantri Awas Yojana Loan Scheme is being provided by several banks and non-banking finance companies.

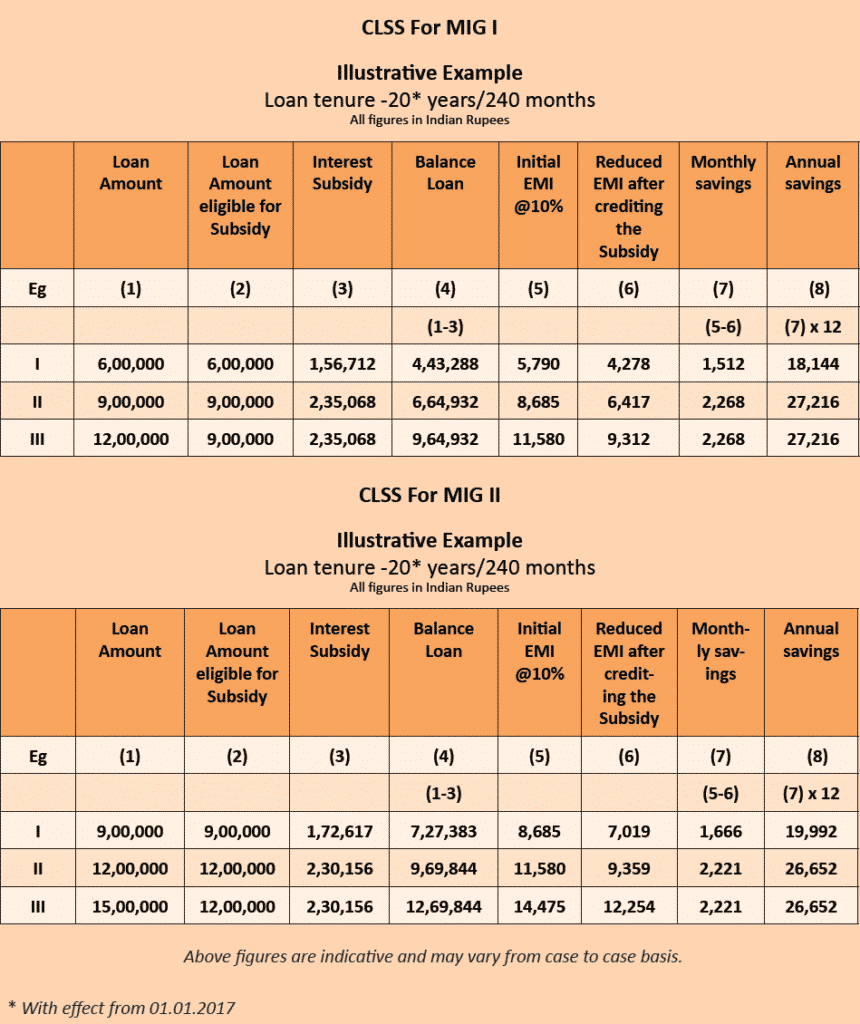

PMAY (CLSS) Loan Scheme MIG Interest Rates / Subsidy

PM Awas Yojana Loan Scheme MIG Interest Rates & Subsidy: Pradhan Mantri Awas Yojana home loan scheme 2022 for middle income group (MIG) has been announced by the central government. The government has now included middle income group under the credit-linked subsidy component of the scheme to provide interest subsidy on the housing loans. Under the scheme, the monthly installment for the housing loans taken will come down by Rs. 2000. The government has introduced two MIG categories, MIG-1 and MIG-2 under the new loan scheme.

Persons who have taken/applied for housing loan on or after January 1st 2017 would be eligible to take benefits of up to Rs. 2.35 Lakh under the scheme. Under the new PMAY home loan scheme for MIG, urban families with household income of up to Rs. 18 lakh per annum would be able to take benefits of the scheme. The government has signed MoU with 70 lending institutions for providing home loans to beneficiaries under CLSS for MIG.

PM Awas Yojana Loan Scheme MIG Interest Rates, Subsidy & EMI

You can now check the PM Awas Yojana Loan Scheme MIG Interest Rates in the table below:-

| Particulars | MIG – 1 | MIG – 2 |

|---|---|---|

| Household income per annum | 12 Lakh | 18 Lakh |

| Interest Subsidy (per annum) | 4% | 3% |

| Maximum loan tenure in years | 20 | 20 |

| The eligible loan amount for interest subsidy under CLSS for MIG | 9 Lakh | 12 Lakh |

| Discount rate for Net Present Value (9%) calculation of interest subsidy | 9% | 9% |

| Maximum interest subsidy | 2.35 Lakh | 2.3 Lakh |

| Dwelling unit carpet area up to | 160 sq. Mt. (Previously 120 sq.m) | 200 Sq. Mt. (Previously 150 sq.m) |

| Monthly EMI @ 8.65% without interest subsidy | Rs. 7,894 | Rs. 10,528 |

| Monthly EMI @ 8.65% with interest subsidy | Rs. 5,834 | Rs. 8,509 |

The total interest subsidy accruing on these loan amounts will be paid to the loan account of beneficiaries up front in one go there by reducing the burden of Equated Monthly Installment (EMI). Additional loans beyond the aforementioned specified limit, if any, will be at non-subsidized rate. There would be no processing fee charged by the PLI’s for applications under the CLSS. The PM Awas Yojana Loan Scheme MIG Interest Rates will remain applicable for the entire duration of the scheme.

PMAY CLSS for MIG – Eligibility & Guidelines

Apart from the family as comprising of wife, husband and unmarried daughters and sons, single unmarried youth and earning young adults can also apply for the subsidy under the CLSS for MIG loan scheme. Women with overriding preference to widows, single working women, persons belonging to SC/ST, BC, Differently abled and Transgender people would be given preferences for loans under the scheme. To be eligible for interest subsidy under CLSS for MIG:-

- The beneficiary family should not own a pucca house either in his/her name or in the name of any member of his/her family in any part of India.

- A beneficiary family should not have availed of central assistance under any housing scheme from Government of India.

PM Awas Yojana Loan Scheme MIG Interest Rates must be checked once before applying for the PMAY Home Loan Scheme.

Application Procedure & Steps for PMAY Loan for MIG

EMI Calculator – PMAY Loan for MIG

As per the PM Awas Yojana Loan Scheme MIG Interest Rates, the EMI will be as follows:-

The government has also increased the loan tenure of the CLSS for EWS/LIG from 15 years to 20 years.

Features of PMAY Credit Linked Subsidy Scheme for MIG

PM Awas Yojana Loan Scheme MIG Interest Rates and other details about the PMAY MIG Loan Scheme are mentioned here:-

| Details | MIG I | MIG II |

|---|---|---|

| Household Annual Income (Rs.)Min. | 6,00,001 | 12,00,001 |

| Household Annual Income (Rs.)Max. | 12,00,00 | 18,00,000 |

| Income Proof for Claiming Subsidy | Self Declaration | Self Declaration |

| Property Carpet Area (sq.m.) Up to | 160 | 200 |

| Property Location | All Statutory Towns as per Census 2011 and towns notified subsequently | All Statutory Towns as per Census 2011 and towns notified subsequently |

| Applicability of No Pucca House | Yes | Yes |

| Woman Ownership/Co-ownership | No | No |

| Due Diligence Process | As per the process of the Primary Lending Institution | As per the process of the Primary Lending Institution |

| Eligible Loan Amount | As per the policy applied by the Primary Lending Institution | As per the policy applied by the Primary Lending Institution |

| Identity Proof | Aadhaar No. | Aadhaar No. |

| Housing Loan Sanction and Disbursement Period From | 1 January 2017 | 1 January 2017 |

| Loan Amount (Rs.) Min. | 0 | 0 |

| Loan Amount (Rs.) Max. | 9,00,000 | 12,00,00 |

| Loan Tenure (Years) Max. | 20 | 20 |

| Interest Subsidy (% p.a.) | 4.00 | 3.00 |

| Discounted Rate for Net Present Value (NPV) calculation for interest subsidy – NPV Discount Rate (%) | 9.00 | 9.00 |

| Max. Interest Subsidy Amount (Rs.) | 2,35,068 | 2,30,156 |

| Loan Category at the time of crediting the subsidy | Standard Asset | Standard Asset |

| Lumpsum amount paid per sanctioned Housing Loan application in lieu of processing fee (Rs.) | 2,000 | 2,000 |

| Quality of House/Flat Construction | National Building Code, BIS Codes, and NDMA Guidelines adopted | National Building Code, BIS Codes, and NDMA Guidelines adopted |

| Approvals for the Building Design | Compulsory | Compulsory |

| Basic Civic Infrastructure (water, sanitation, sewerage, road, electricity etc.) | Compulsory | Compulsory |

| Monitoring and Reporting the Completion of Property Construction | Responsibility of the Primary Lending Institution | Responsibility of the Primary Lending Institution |

| Default Repayment of Loan | Recover and Pay back subsidy to CNA on a proportionate basis | Recover and Pay back subsidy to CNA on a proportionate basis |

| Data Submission & Accuracy, and Record-Keeping & Maintenance | Responsibility of the Primary Lending Institution | Responsibility of the Primary Lending Institution |

PMAY CLSS MIG Loan Scheme Earlier Updates

Along with the PM Awas Yojana Loan Scheme MIG Interest Rates, you can now check some earlier updates about the scheme. Here are some of the updates as released from time to time regarding PMAY CLSS MIG Housing Loan Scheme. ***Language of Writing is as of the updated date***.

PMAY Urban CLSS MIG – Increase in Carpet Area of Houses Eligible for Interest Subsidy (Update on 12 June 2018)

Ministry of Housing and Urban Affairs (MoHUA) released new notification on 12 June 2018 to boost Affordable Housing. This notification is regarding an “Increase in the Carpet Area of Houses Eligible for Home Loan Interest Subsidy under Credit Linked Subsidy Scheme (CLSS) under Pradhan Mantri Awas Yojana (Urban) for the Middle Income Group (MIG)”. Now the Carpet Area under CLSS Component of PMAY-U is increased from 120 square metre to 160 sq.m for MIG I and from 150 sq.m to 200 sq.m for MIG II.

After this decision of increasing the carpet area for housing loan interest subsidy, Construction sector will get a major boost and will lead to enhanced economic activity. Now more MIG people will qualify for Subsidies under PMAY-U. Moreover, this initiative will also work well with the Revised RBI Housing Loan Limits For PSL.

Increase in Carpet Area under PMAY Home Loan Yojana

The important features and highlights of Interest Subsidy under the CLSS component of PMAY Home Loan Yojana are as follows:-

- In a major boost to the housing sector, govt. has approved to increase the carpet area for houses eligible for Home Loan Interest Subsidy under CLSS under PMAY-U.

- As a result of this decision, now more MIG customers will qualify for subsidy under Pradhan Mantri Awas Yojana Urban. This would result in enhanced economic activity and construction activities.

- Recently RBI revises housing loan limits for PSL eligibility from Rs. 28 lakh to Rs. 35 lakh in metropolitan areas (with a population of 10 lakh or above) and from Rs. 20 lakh to Rs. 25 lakh till the dwelling cost does not exceed Rs. 45 lakh and Rs. 30 lakh respectively.

- Increase in the construction activities in Housing Sector will impact other core sectors like cement, steel, machinery and other allied sectors. Moreover, this move will create jobs for both skilled and unskilled workers.

- For more details on decision of Increase in Carpet Area for MIG Home Loan Interest Subsidy Eligibility under CLSS component of PMAY (U). See Official Notification at http://mohua.gov.in/upload/uploadfiles/files/9029212.pdf

MIG Segment plays a very vital role in the growth and development of economy of the country. CLSS for MIG People will support and help in realizing the dream of every family to own a house of their own.

MIG Home Loan Subsidy Eligibility – PMAY Credit Linked Subsidy Scheme (CLSS)

Here we are describing the MIG Home Loan Subsidy Eligibility under CLSS PMAY-U. The decision to increase the carpet area for MIG section was a long time demand of various stakeholders as potential beneficiaries were denied of the subsidy benefits for their homes due to an enlarge carpet area. Now increase in the carpet area will make them eligible for Interest Subsidy under CLSS. This decision is taken after a large number of requests to increase the carpet areas specified for MIG I and MIG II categories.

PMAY CLSS Home Loan Helpline

The home loans subsidy under CLSS scheme of PMAY will be processed through the Central Nodal Agencies. Below are the contact & helpline details of the CNA’s

National Housing Bank (wholly owned by Reserve Bank of India)

Core 5-A, India Habitat Centre, Lodhi Road, New Delhi 110 003

CLSS Tollfree No: 1800-11-3377; 1800-11-3388

E-mail: clssim@nhb.org.in

Housing and Urban Development Corporation Ltd. (A Govt. of India Enterprise)

Core 7-A, India Habitat Centre, Lodhi Road, New Delhi – 110 003

CLSS Tollfree No: 1800-11-6163

E-Mail: hudconiwas@hudco.org

The assessment applications for PMAY-U are being invited through the online mode through official website pmaymis.gov.in of PM Awas Yojana.

No comments